We offer many amazing planning ahead strategies and crisis strategies for someone who is interested in qualifying for public government benefits like Medicaid and Veterans Aid and Attendance.

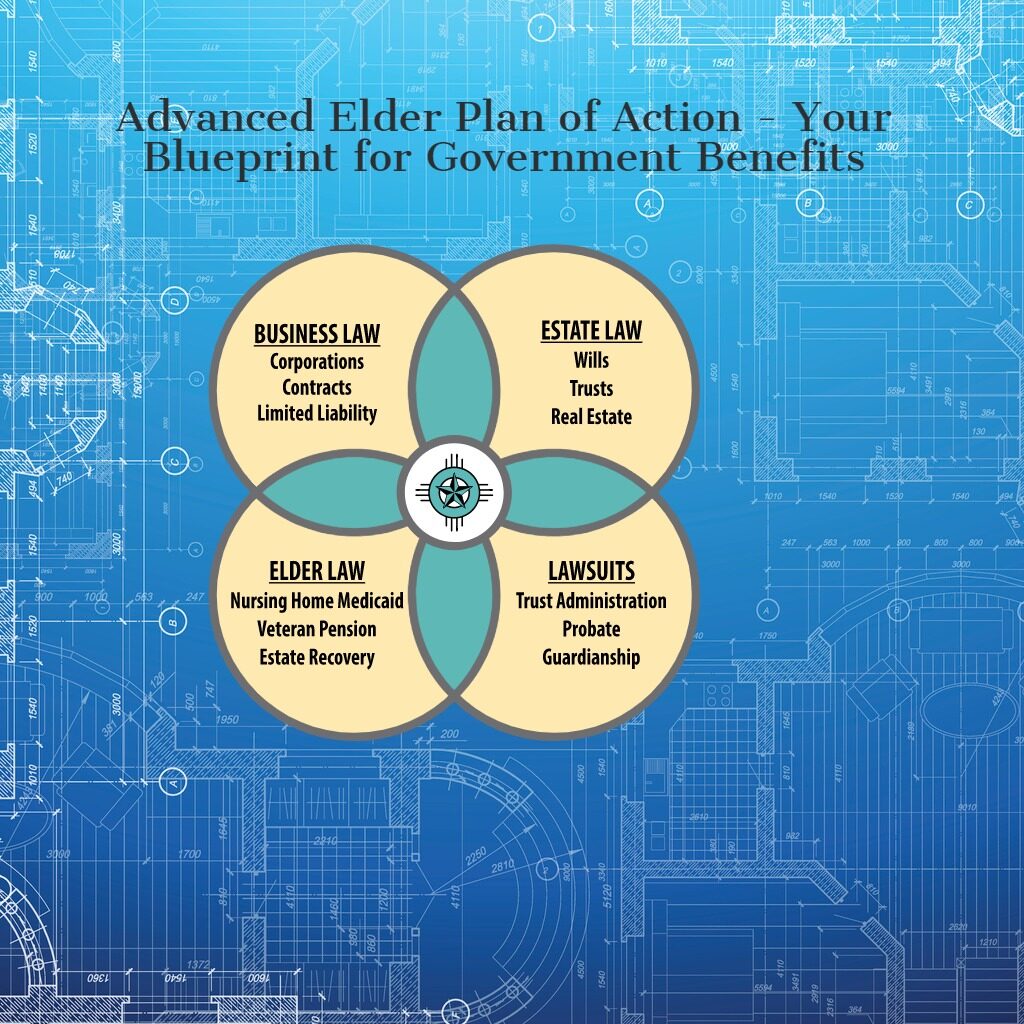

In our office it begins with the Advanced Elder Plan of Action. That’s what I call the planning process and the playbook letter that we prepare for someone who wants us to answer questions about how to qualify for government benefits. The Advanced Elder Plan of Action is styled as a letter to the person who needs care and benefits, but it can also be described as a blueprint or playbook. Think of it as a roadmap for the strategy of your case to get qualified for Medicaid or Veterans Aid and Attendance.

The Advanced Elder Plan of Action will comprehensively describe the income and assets of the person (and spouse if applicable) who will be applying for benefits. In our experience, many older persons or disabled persons do not have a detailed balance sheet of their assets and income. We need that because the agencies responsible for processing applications for government benefits require that information. We met with only one prospect in 15 years who refused to disclose her assets and income knowing full well that she was giving up her opportunity for benefits, which could have been hundreds of thousands of dollars over her and her husband’s lifetimes. She valued her privacy that much!

Once we know what the applicant has (assets and income), we compare that against what the government program requirements are. We provide you with specific requirements of the general rules and regulations of the government programs in which you are interested.

The last part of the advanced elder plan of action are the detailed strategies for dealing with excess income or assets. That is, how to save some money and still qualify for the benefit. For example, if you have too much income, the letter may suggest using a Miller Trust. If the applicant has $100,000 in excess assets, then there might be a few different planning strategies to deal with the excess assets and get the applicant qualified for benefits. We might suggest using a Medicaid Asset Protection Trust or a Veterans Asset Protection Trust, or more. There are about 23 strategies that you we often use depending on the value of your assets, the type of assets held, and the circumstances of the applicant and his or her family.

Remember that we must account for any prior uncompensated transfers (gifts) in the Advanced Elder Plan of Action, and we must take into account any transfers that happened during the look-back period. We also account for long-term care insurance, debts that the applicant has, and other general information about benefit eligibility.

The Advanced Elder Plan of Action can be used in a proactive planning case, where the applicant is planning in advance, or in a crisis planning case where the applicant needs to qualify for Medicaid right away. Some people are wait-and-see people, and some people are planners. If you know what you are going to be doing tomorrow, next week, next month, and next year, you are probably the planning ahead type.

The Advanced Elder Plan of Action a blueprint of the case to keep the applicant and his or her family on track, so that you are aware of how the case should proceed. You and the applicant get a clear picture of what is going to happen in the application process, with the numbers and strategies to back it up.

If the applicant and/or his or her spouse is a Veteran, we can help you understand that application process as well. Some of our clients have qualified for both benefits. Keep in mind that all of the facts and circumstances of the applicant’s family are important. We might consider using other strategies and tools such as special needs trusts (SNT), including a First-Party SNT, Third-Party SNT, Parental Protection Trust, Sole Benefit Trust, and Secure SNT. There are protection trusts, including the Medicaid Asset Protection Trust, and the Veterans Asset Protection Trust. The foundation of ever individual’s planning should be getting their affairs in order with Last Will and Testament, Revocable Living Trust, Financial Durable Powers of Attorney, Healthcare Medical Powers of Attorney, and Directive to Physicians (known as the living will).