Act Now to Preserve Your Cyber Legacy: Estate Planning for Your Digital Assets

There’s an entire category of commonly-overlooked legacy to consider – digital assets. Don’t worry if you didn’t consider these assets when made your will or trust – it’s surprisingly common and, luckily, easy to correct.

What are digital assets? They include:

- your photos (yes, all those selfies are a digital asset),

- files stored in the cloud or on your local computer,

- virtual currency accounts,

- URLs,

- social media profiles (Facebook, LinkedIn, etc.)

- device backups,

- databases,

- digital business documents,

- Airline Rewards

- Hotel Points

- Email Accounts

- Social Networking Accounts

- Voicemail Accounts

- Online Photographs and Videos

- Image Sharing Accounts

- iTunes

- Web pages

- Online Purchasing Accounts

- Bitcoins

- because technology is ever-evolving, much more will be added as the months and years go by.

These assets can have real value, such as virtual currency accounts, a URL, or digital business assets. So, you can no longer adopt a wait-and-see approach for these assets. Whether you proactively plan or not, your legacy now includes more than the inheritance you want to pass along, your family heirlooms, and general assets. You must now consider your digital assets.

The Texas legislature just passed and the governor signed the Texas Uniform Fiduciary Access to Digital Assets Act. It becomes effective September 1, 2017. The following laws were also added or amended to coordinate with the Texas Uniform Fiduciary Access to Digital Assets Act: (Est. Code Ch. 2001 (New), Secs. 752.051, 752.1145, 752.115, 1151.101, Prop. Code Sec. 113.031).

Don’t rely on your spouse to give you his or her password to all of your accounts. A petitioner in a New York court filed a lawsuit against Google, “requesting authority to access his deceased spouse’s Google email, contacts and calendar information in order to “be able to inform friends of his passing” and “close any unfinished business etc.”

1. Inventory your digital assets. Make a list of every online account you use. If you run a business, don’t forget spreadsheets, digital records, client files, databases, and other digital business documents, although those should probably be part of your business succession plan. If it exists in cyberspace, connects to it or pertains to it, put it on the list for your attorney and executor.

2. Designate a cyber successor. A cyber successor is someone you trust who can access your accounts and perform business on your behalf after you are gone or in the event you are incapacitated. Make sure they can access your accounts in a timely manner. Safeguard your list, so that it doesn’t end up being vulnerable to unauthorized access, identity theft, data loss, or worse. All of Google’s sites and apps allow you to name an Inactive Account Manager to share parts of your account data or notify someone if you’ve been inactive for a certain period of time. https://support.google.com/accounts/answer/3036546?hl=en. “Inactive” means you are disabled, incapacitated, incarcerated, or deceased. Facebook allows you to name a “legacy contact” https://www.facebook.com/help/1568013990080948?helpref=faq_content

3. Determine the necessary documents for your estate, and make a record of your wishes. You may want to put some of your digital assets into a trust or even include specific access in a power of attorney. Consult with an estate planning attorney to determine the best way to determine your successors, trustees, and beneficiaries, and then make sure the right documents or designations are in place so access can be made when it’s needed. The laws in this arena are evolving, so any planning you’ve done in the past probably needs an update.

Potential Pitfalls of Cyber Estate Planning

The worst thing you can do is to procrastinate. Refusing or failing to take action is not a good estate planning technique. Failing to take action could result in the loss of digital family photo albums, disruption of your business if you’re incapacitated, or worse.

If this process feels daunting or you’re still not sure where or how to start, give us a call at 210-530-4278, 830-488-7614, 512-766-3782, or 575-430-2353. We can help you identify, track, and protect your digital assets to give you peace of mind.

PLAYING IT SAFE…WITH YOUR WILL!

Woohoo!!! Your Will is finalized…That is such a great feeling! You were proactive in your estate planning…you made an appointment and met with an attorney…you discussed your estate-planning goals….a Will and other supporting documents (such as your Medical Power of Attorney and your Financial Power of Attorney and your Health-Care Directive and your HIPAA Authorization) were drafted for you…you were called back into the law office to sign your Will…you were handed over your estate planning binder (with your original Will and the original supporting documents)…Now what???…What should you do with your original Will??? You are ultimately responsible for your original documents. The importance of storing your original Will properly cannot be overemphasized.

Please call us at 210-530-4278 if you would like more information about getting to that wonderful feeling of having your estate plan in order. Marquardt Law Firm would love to discuss your estate planning needs with you!

When you finalize your Will, your job is not over quite yet. You need to properly store your original Will and you should notify your named Executors and/or beneficiaries as to the location of your Will. Storing your Will is just as important as creating it…because if that Will (or a copy of that Will) cannot be found, it is like you never had a Will at all. (A copy of a Will can be probated, but it is a more difficult probate which may mean more time delays and more legal fees and court costs, and there must also be clear evidence presented to the court as to what happened to the original Will.) A Will destroyed by fire, flood, or taken by theft is not as common as simply misplacing or losing it. All too often, families cannot locate the Will even after going through box after box of unending papers and tearing the house upside down. Where should you store your Will then? We have some recommendations for you listed below. When you are reading through the possible storage recommendations for your Will, think about which one would work best for you.

Storing at Home. It is recommended that you store your original Will in your home where you would normally store your other important financial documents. If you elect to store your Will in your home, you can always provide copies of your Will (please remember to not remove the staples from your original Will when making copies) to your named Executor (both the first named and the successor Executors because your Executors may predecease you) and/or to the named beneficiaries under your Will. A fire-safe document box or cabinet would be great. A safe would be great. We recommend a place where you would normally store your will so that your Will is easily located by your named Executors or beneficiaries. Providing copies of your Will to others is your own personal choice, but please make sure a trusted person knows where to locate your original Will.

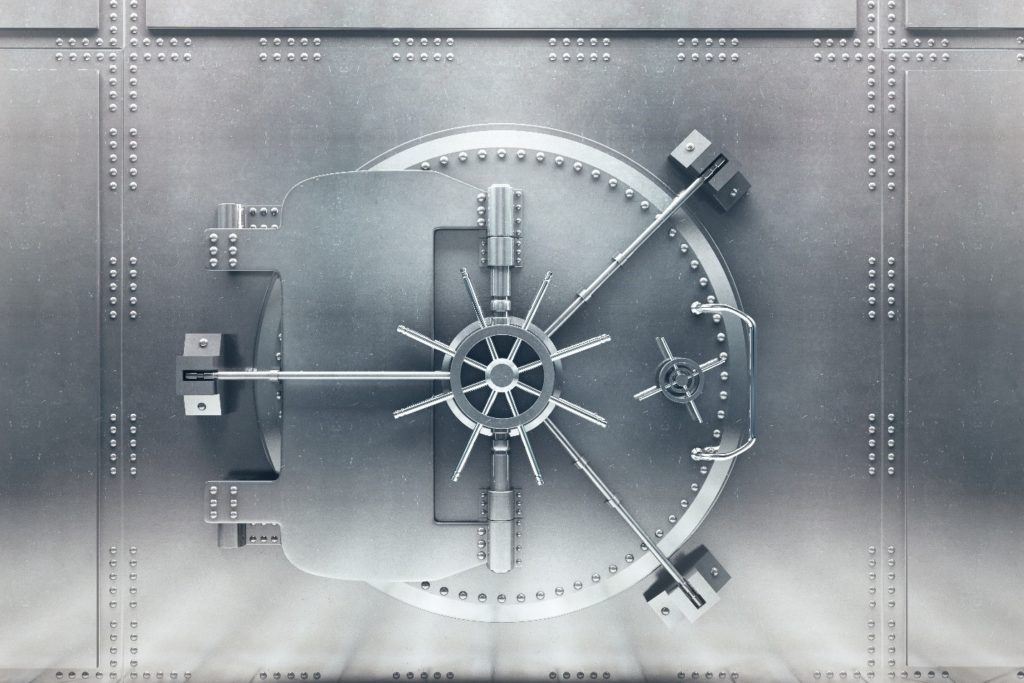

Storing in a Safe-Deposit Box. If your home is not a safe place to store your original Will, storing your Will in a safe-deposit box at a bank would be fine also. However, you must be sure to alert your named Executors and Beneficiaries as to the location of your Will. The only issue with storing your Will in a safe-deposit box in a bank is that, when you pass away, the bank will not open the safe-deposit box for your Executors until after your Will (your original Will in the safe-deposit box that your Executors cannot retrieve) has been probated…unless a Court orders the safe-deposit box opened beforehand. If you want to avoid this Catch-22 situation, it is important to make some arrangements with the bank to allow your named Executors access to the safe-deposit box (and your original Will) after your death. Or, you can name a trusted person as co-owner of the safe-deposit box. Otherwise, the probate process may be delayed for a few weeks…and more legal fees and court costs incurred until the Court orders the safe-deposit box opened (Texas law has a procedure for requesting that the probate court order a safe-deposit box of the decedent to be opened).

Storing with the County Clerk. Again, if your home is not a safe place to store your original Will, there is a Will safekeeping service provided by all the county clerks in Texas. Yes, you may store your original Will with your county clerk at the courthouse. There is a small fee for this service, and you may be required to provide the county clerk with the names and addresses of several people…people you trust…who are authorized to claim your Will after you pass away. These named individuals will be required to present your death certificate and some identification to the county clerk to claim your Will after your death. The catch here is that the county clerk will not know when you pass away and therefore will not send your Will to the probate court and will not send your Will to your named Executors or beneficiaries. Therefore, it is very important that you let your named Executors and beneficiaries know that you have deposited your Will with the county clerk. If you do not notify your named Executors and beneficiaries, they may never know where your original Will is located when you die. And, if you move to another state or county, you will need to claim your Will from the county clerk and refile it with the county clerk of your new residence if you wish to do so again.

At Marquardt Law Firm we provide our Clients with a computer thumb drive containing copies of their Will and other supporting documents in addition to their estate planning binder. Marquardt Law Firm also recommends that our Clients make sure that their named Executors know that we strive to keep scanned copies of our Clients’ documents which may be important if ever a Will is lost or misplaced. Please call us at 210-530-4278 if Marquardt Law Firm can assist you in your estate planning needs!

Once your Will is properly stored…and your named Executors and/or beneficiaries are notified as to the location of your Will…Congratulations are now in order!!!…Your job is complete!